Locate Your Perfect Match: Made Use Of GMC Cars in Morris with Financing Options

Locate Your Perfect Match: Made Use Of GMC Cars in Morris with Financing Options

Blog Article

The Essentials of Car Financing: Described

In the globe of automobile funding, browsing the complexities of rate of interest rates, car loan kinds, approval factors, and settlement estimations can be a challenging task. Understanding the basics of vehicle funding is vital for anybody aiming to buy a car, whether it's a newbie purchaser or an experienced auto owner. As we look into the basics of automobile financing, we will uncover key understandings that can help you make educated choices and protect the best possible bargain for your following automobile purchase.

Comprehending Rate Of Interest

Interest prices play a considerable function in determining the general expense of a vehicle lending and can greatly affect the month-to-month payments and complete amount paid over the life of the loan. When applying for an automobile loan, the rate of interest rate is essentially the price you pay for obtaining the money from the loan provider.

Rate of interest can be either repaired or variable. Dealt with rate of interest continue to be the very same for the whole period of the financing, giving stable month-to-month settlements. GMC Parts In Morris. On the other hand, variable rates of interest can rise and fall based upon market problems, possibly leading to transforming month-to-month settlements

Variables that can influence the rates of interest supplied to you include your credit rating, the car loan term, the quantity obtained, and the financial environment. It is essential to look around and compare deals from different loan providers to protect the most beneficial rate of interest for your automobile funding requirements.

Kinds Of Automobile Loans

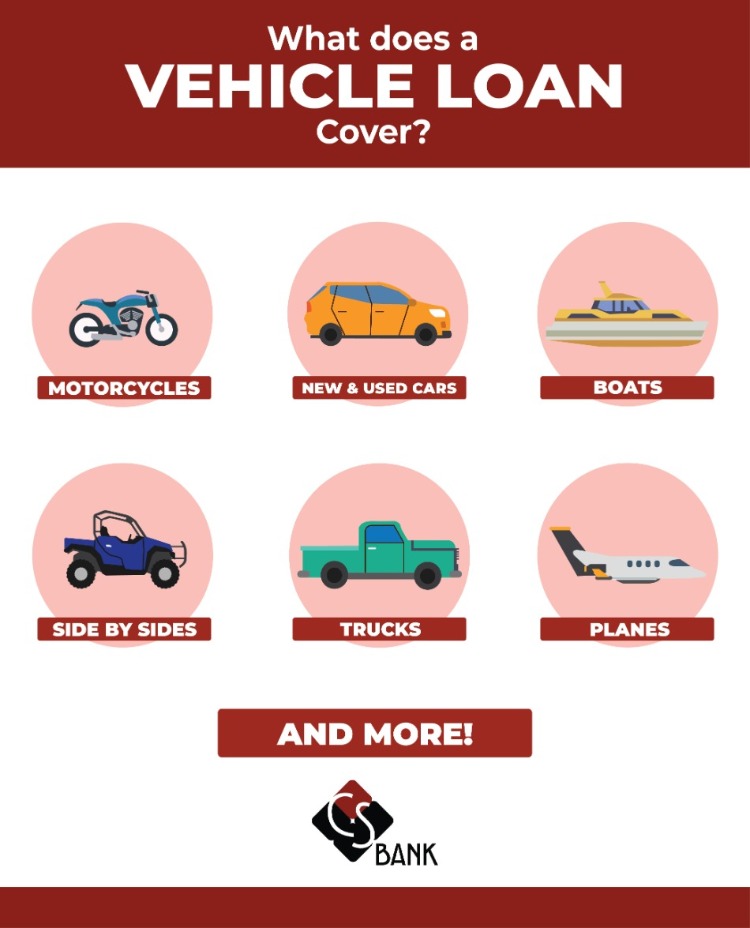

When taking into consideration cars and truck financing choices past rate of interest, recognizing the different kinds of auto loan offered is important for making informed decisions. One typical kind of vehicle loan is a traditional vehicle funding, where the consumer takes out a financing from a bank, lending institution, or on-line lender to acquire a lorry. An additional option is a dealership financing, where the auto is funded with the dealer. Dealer funding can sometimes offer unique promos or rewards. Lease agreements are additionally preferred, permitting people to essentially rent out an automobile for a set period with an option to purchase the end. For those with less-than-perfect credit score, subprime vehicle loan are readily available however frequently included higher interest rates. In addition, individuals might go with a personal lending to finance an automobile acquisition. Comprehending the distinctions between these kinds of car fundings can aid people pick the option that ideal matches their financial scenario and demands.

.jpg)

Factors Affecting Loan Authorization

Factors influencing lending authorization include an individual's credit rating, income stability, and debt-to-income ratio. Lenders use these key factors to examine the borrower's creditworthiness and capacity to pay off the finance.

Debt Rating: A high credit history suggests a background of liable credit history administration, enhancing the chance of finance authorization. Lenders view customers with greater credit rating as less dangerous.

Revenue Stability: Lenders assess a person's income stability to ensure they have a reliable source of income to make timely funding settlements. A consistent earnings stream reduces the danger of default.

:max_bytes(150000):strip_icc()/how-to-get-pre-approved-for-a-car-loan-7485858-final-585e6b57c4374f26805bf922206eb7e8.jpg)

Determining Monthly Settlements

To identify regular monthly settlements for automobile funding, borrowers must take into consideration the car loan quantity, interest price, and car loan term. The financing amount stands for the total sum obtained from the loan provider to acquire the lorry. A higher funding amount will certainly cause higher regular monthly settlements. The rate of interest is the percent charged by the loan provider for borrowing the cash. A lower rate of interest can significantly decrease the monthly settlement worry. The loan term is the period in which the debtor concurs to settle the finance. Much shorter finance terms normally have higher monthly settlements however lower general interest prices, while longer car loan terms lead to lower month-to-month payments yet greater complete passion used gmc cars in morris paid over the life of the funding. Calculating month-to-month repayments can be done using an online loan calculator or through hands-on calculations utilizing the finance quantity, rates of interest, and financing term. Comprehending just how these aspects interaction is important for customers to make informed decisions about their automobile funding choices.

Tips for Getting the very best Deal

When seeking the ideal offer on automobile funding,Understanding how car loan terms and passion rates impact monthly settlements is important. To get one of the most desirable terms, beginning by looking into present rates of interest from different loan providers, including banks, lending institution, and online lenders. Contrast these rates to discover the most affordable one offered to you based upon your credit report. Additionally, take into consideration the financing term size. While a much longer loan term might result in reduced regular monthly settlements, it can additionally suggest paying more in passion over the life of the financing. Purpose for the fastest loan term you can pay for to save money on interest costs.

By negotiating the cars and truck rate first, you can concentrate only on obtaining the best funding terms. Be sure to read and recognize all the terms and conditions of the financing contract before authorizing to avoid any surprises down the road.

Verdict

To conclude, recognizing the basics of car funding is vital for making educated choices when acquiring a lorry. By learning more about rate of interest, sorts of vehicle finances, aspects impacting finance approval, and how to determine month-to-month settlements, people can protect the very best feasible bargain. It is very important to research and contrast options to ensure monetary security and avoid potential challenges in the vehicle financing procedure.

One usual type of automobile financing is a standard auto lending, where the debtor takes out a finance from a bank, credit rating union, or on-line lending institution to acquire a lorry.To figure out month-to-month payments for vehicle funding, borrowers need to consider the car loan amount, interest rate, and lending term. Shorter finance terms normally have greater regular monthly payments yet lower overall rate of interest expenses, while longer lending terms result in lower month-to-month settlements however greater total interest paid over the life of the finance. Calculating monthly repayments can be done using an online lending calculator or with hands-on calculations utilizing the loan quantity, interest price, and funding term. GMC Parts In Morris. By discovering regarding interest prices, types of vehicle finances, elements affecting finance approval, and how to compute month-to-month repayments, people can safeguard the ideal possible bargain

Report this page